Menu

Get In Touch

Key Benefits

Why choose Finnova?

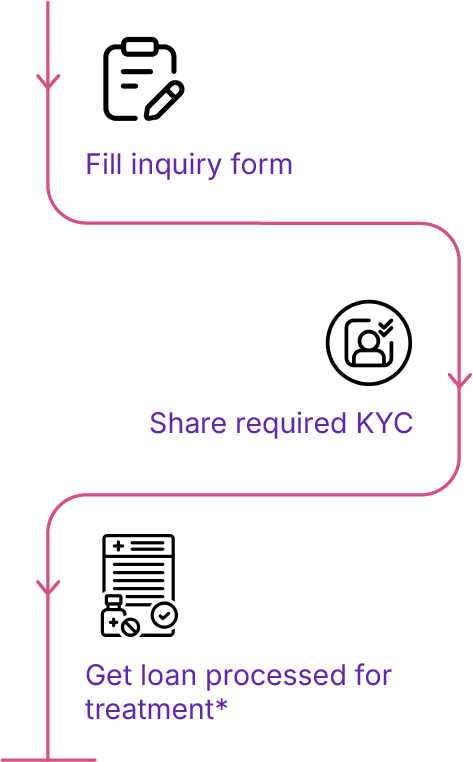

How to Apply?

Get Your Medical Loan In

3 Quick Steps

About Us

At Finnova, we believe that access to healthcare should never be compromised due to liquidity constraints. By bridging the gap between urgent medical expenses and limited or no insurance coverage, Finnova enables hospitals and patients to maintain continuity of care without funding shortfalls.

With 62% of healthcare expenses in India paid out-of-pocket, households often face cash flow strain, asset liquidation, or deferred treatment. Finnova addresses these challenges by offering instant credit assessment, direct hospital settlements, and structured repayment options—ensuring treatment affordability without compromising financial stability.

Our platform strengthens the healthcare ecosystem by:

- Enhancing patient liquidity through immediate financing solutions

- Reducing bad debt exposure for hospitals via timely settlement

- Preserving working capital for families by preventing asset liquidation

- Expanding healthcare access through inclusive and transparent patient financing

Finnova Impact:

- 30,000+ patients supported

- 5,000+ partner hospitals across India

- Platform developed by Volo Health Services, impacting 2.5M+ lives

Frequently Asked Questions

Any patient undergoing treatment is eligible to apply for the loan. Loan approvals are based on quick digital checks and do not require lengthy procedures.

Typically, only basic KYC documents (Aadhaar, PAN, income proof if required) are needed. The process is simple and fully digital.

Most loans are approved within minutes when the eligibility criteria are met, ensuring patients don’t face delays in starting their treatment.

Finnova offers flexible repayment options, including EMIs tailored to patient needs. Repayments can be made monthly through convenient digital channels.

No. Finnova offers zero pre-closure charges and maintains complete transparency with patients about repayment terms.

Repayments are reported like any other financial product. Timely repayment can improve your credit score, while delays may impact it.