Menu

Get In Touch

Key Benefits

Why choose Finnova?

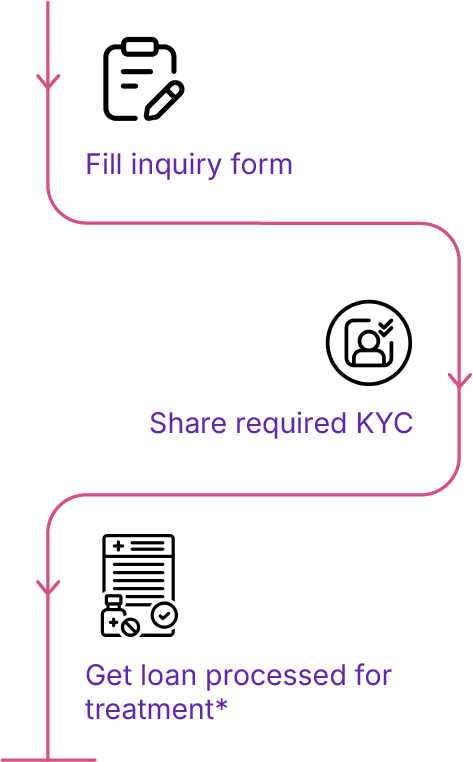

How to Apply?

Patient Financing in

3 Quick Steps

About Us

At Finnova, we believe that access to healthcare should never be compromised due to liquidity constraints. By bridging the gap between urgent medical expenses and limited or no insurance coverage, Finnova enables hospitals and patients to maintain continuity of care without funding shortfalls.

With 62% of healthcare expenses in India paid out-of-pocket, households often face cash flow strain, asset liquidation, or deferred treatment. Finnova addresses these challenges by offering instant credit assessment, direct hospital settlements, and structured repayment options—ensuring treatment affordability without compromising financial stability.

Our platform strengthens the healthcare ecosystem by:

- Enhancing patient liquidity through immediate financing solutions

- Reducing bad debt exposure for hospitals via timely settlement

- Preserving working capital for families by preventing asset liquidation

- Expanding healthcare access through inclusive and transparent patient financing

Finnova Impact:

- 30,000+ patients supported

- 5,000+ partner hospitals across India

- Platform developed by Volo Health Services, impacting 2.5M+ lives

Frequently Asked Questions

Finnova provides instant credit to patients, ensuring hospitals receive timely payments without delays. This reduces receivables, strengthens cash flow, and allows hospitals to focus on delivering uninterrupted care.

No hidden fees. Finnova operates transparently, with terms agreed upfront. Hospitals benefit from improved patient retention and faster settlements without additional financial burden.

Yes. Finnova is designed to integrate seamlessly with hospital billing and administration processes, minimizing disruption to existing workflows.

We offer dedicated support, training, and easy-to-use dashboards so finance teams can track settlements, repayments, and patient status in real time.

Yes. By offering patients instant access to medical credit, hospitals reduce treatment dropouts due to financial stress. This leads to higher retention, improved outcomes, and stronger patient trust.

Hospitals receive settlements within hours of approval. Our digital-first platform ensures a smooth process, eliminating lengthy paperwork and delays.